Finance and accounting specialist with federal certificate of proficiency

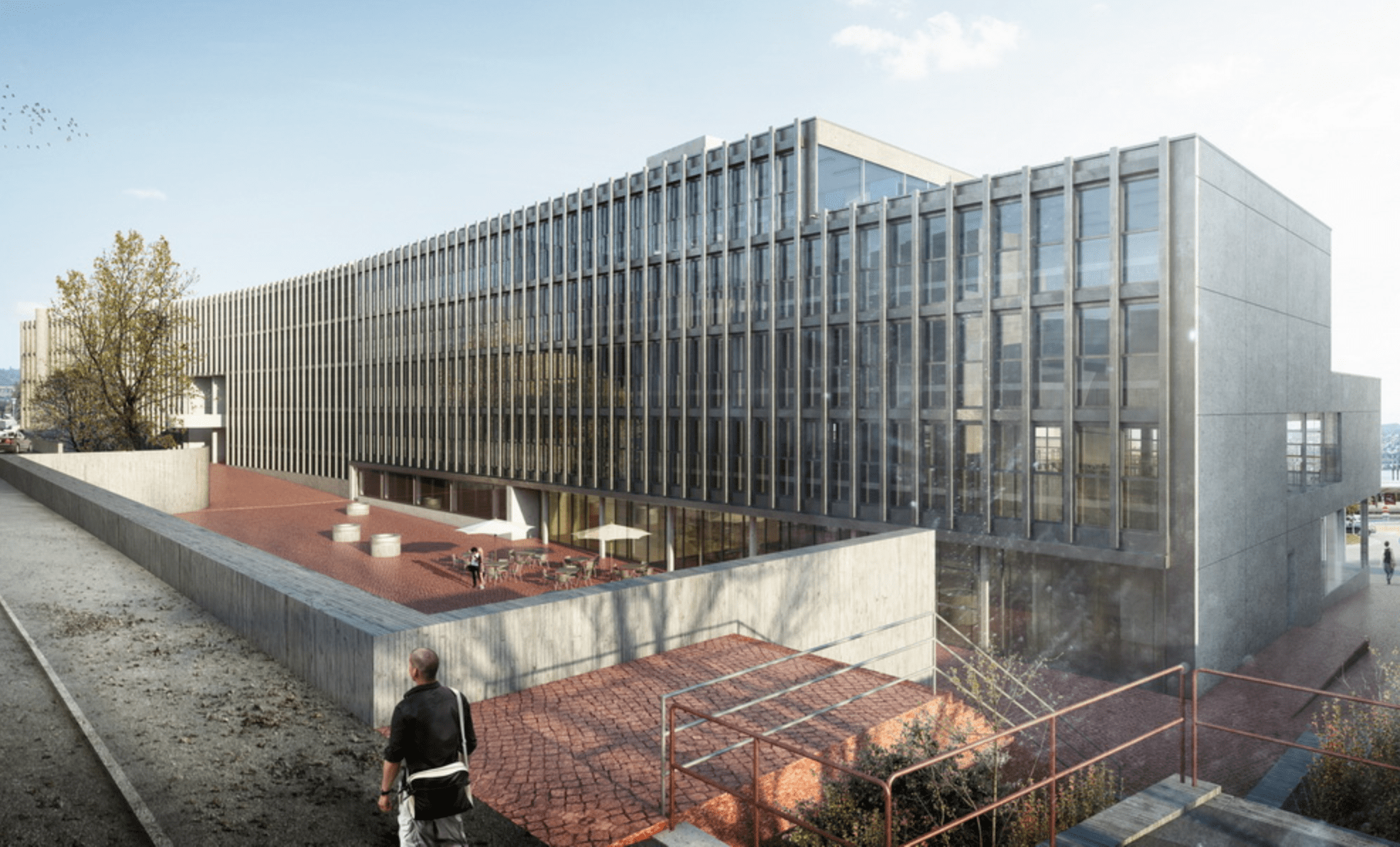

Provider: Lake Zurich Education Center

About

Description

Managing an accounting department, preparing the consolidated financial statements or assessing the financial matters of contracts - financial specialists ensure reliable figures.

The holder of the specialist certificate has in-depth knowledge of all areas of financial and managerial accounting in a small and medium-sized enterprise. In addition, he/she is capable of implementing demanding tax, social security and legal regulations in his/her professional environment in a practical manner.

Due to the thorough theoretical training and several years of practical experience, the finance and accounting specialist is able to assume a management function in accounting in a small or medium-sized company or to act as a commercial manager.

Irrespective of the size of the company, the accounting specialist is able to perform qualified tasks efficiently, reliably and practically in all areas of financial and operational accounting.

Since the finance and accounting specialist not only has a sound knowledge of accounting, but also a good knowledge of tax law, payroll accounting and social security, he/she can also perform fiduciary tasks competently and reliably.

The professional examination determines whether candidates possess the skills and knowledge in the areas of accounting, taxation, social insurance and law required to practice the profession.

The professional examination ensures that the basic knowledge required for higher professional examinations for experts in accounting and controlling, tax experts, fiduciary experts and auditors is available.

The professional examination makes it easier for business and administration to select professionally qualified specialists in accounting.

Requirements

Admission to the examination is granted to those who

a) has one of the following qualifications:

- Swiss Federal Certificate of Proficiency in a trade or a commercial college recognized by the BBZ or a high school diploma;

- Accounting clerk with at least 2 years of training

- Certificate of a professional examination or diploma of a higher professional examination

- Graduation from a higher professional college, a university or a university of applied sciences

b) Proof of 3 years of professional experience

For the purposes of the examination regulations, professional experience means working as a specialist in one or more areas of accounting, trusteeship or taxation. The cut-off date for proof of specialist practice is the date of the start of the examination.

c) Does not have an entry in the Central Criminal Register that contradicts the purpose of the examination.